Market Update - October 20, 2023

This Market Update is written by our Capital Market specialists each week to bring you insight into what's happening in the market and how it may affect mortgage rates and real estate trends.

Market Commentary:

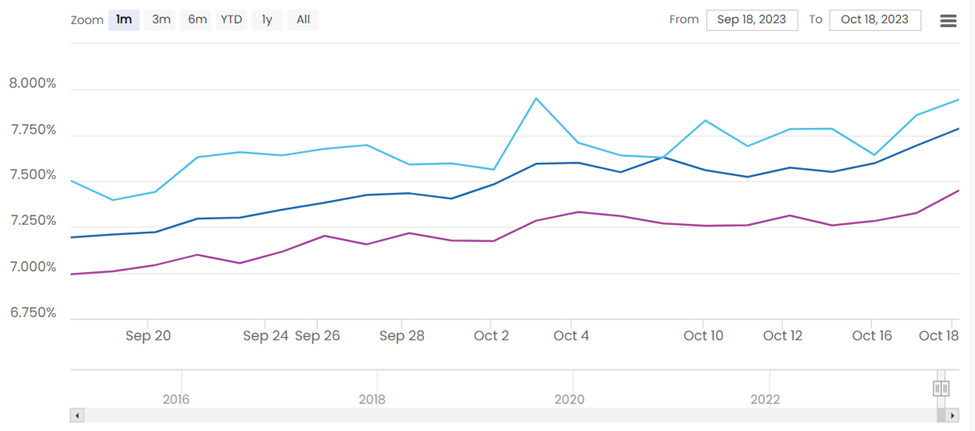

For the week of Oct 13th – Oct 19th, 30-year and 15-year interest rates increased.

Mortgage rates, which increased dramatically in 2022 and have been volatile so far in 2023, are expected to trend down later this year.

In September 2023, the Consumer Price Index rose 3.7% year-over-year. While inflation has slowed significantly since it peaked last year – which is good news for mortgage rates – a more marked reduction is likely essential before we witness a significant drop in mortgage rates.

The Federal Reserve may reach its 2% inflation target rate by early 2025 and it is likely done with its restrictive monetary policy, said Mike Fratantoni, Mortgage Bankers Association (MBA) chief economist and senior vice president, at the Market Outlook session on Sunday at the MBA Annual Conference in Philadelphia.

Fratantoni said he did not expect the central bank would raise interest rates in November and said there was a minimal chance they would do so in December. He is also anticipating that the central bank will cut interest rates three times in 2024.

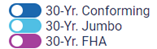

Mortgage Rate Forecasts Through Mid-2024

Fannie Mae and the Mortgage Bankers Association predict that mortgage rates will fall next year, but they disagree about the fourth quarter of 2023.

Fed Watch: Looking ahead, all eyes are now on the upcoming November 1st Federal Open Market Committee (FOMC) meeting. According to the CME Group, 4.1% of forecasters predict an increase in interest rates, while 95.9% predict rates will remain the same. None of the forecasters expect rates to decrease.

Market Review:

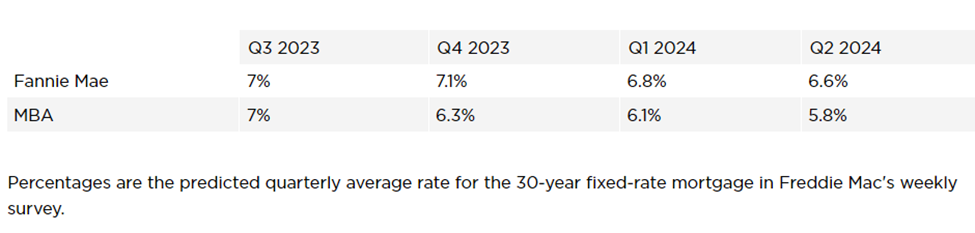

Per Black Knight's Production Metrics, the breakdown of mortgage production volume is as follows: 86.0% for purchase transactions, 12.29% for cash-out refinances, and 1.72% for rate and term refinances.

Per Black Knight 56.93% of all Retail loan production were Government Loans (FHA, VA, USDA), while 43.07% were Conventional and Non-Conforming loans.

News You Can Use:

- Mortgage originations will surge 19% in 2024, MBA says

- Mortgage bankers expect the 30-year rate to drop to 6.1% by the end of 2024

- Housing market predictions: Fannie Mae revises 2023 home price forecast upward

- Housing starts rebound in September despite spike in mortgage rates

- September Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

- Fed's Goolsbee says declining inflation is a trend and not a 'blip'

- Feds Want To Make It Easier for Home Buyers To ‘Build Wealth’ With Accessory Dwelling Units

- White House Announces New Actions on Homeownership

*Communication is intended for Industry Professionals only and not intended for Consumer Distribution

Interest rate and annual percentage rate (APR) are based on current market conditions as of 10/20/2023, are for informational purposes only, are subject to change without notice and may be subject to pricing add-ons related to property type, loan amount, loan-to-value, credit score and other variables. Estimated closing costs used in the APR calculation are assumed to be paid by the borrower at closing. If the closing costs are financed, the loan, APR and payment amounts will be higher. Contact us for details. Additional loan programs may be available. Accuracy is not guaranteed, and all products may not be available in all borrower's geographical areas and are based on their individual situation. This is not a credit decision or a commitment to lend. actual interest rate, APR, and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property, and other factors as determined by Prosperity Home Mortgage, LLC. Not available in all states. Rate is as of 10/20/2023 and is subject to change at any time without notice. Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac's economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Mac's business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current, or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an "as is" basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution.